For example, with a capital lease, in the eyes of the IRS, you’re taking out a loan for your lab equipment. So instead of recording rental expenses on your income statement, you will record a debt on your balance sheet along with the corresponding principal payments. Capital leases also come with the burdensome terms of a bank loan, since they are identical debt instruments. Because of this, capital leases, or finance leases, are considered a purchase of an asset, and are accounted for on the balance sheet. Additionally, all operating leases that began before the new standard took effect need to be transitioned from the old standard, ASC 840, to the new standard. Under the previous lease accounting standard, ASC 840, there were more differences between these two lease classifications than there are now.

Short-term lease cost, or the cash paid for leases under 12 months in total (which will match the expense), is part of the overall required disclosures for “total lease cost”. One consideration, however, is that the materiality threshold for leases under ASC 842 must be applied to whole asset groups, not individual leases. For example, if a company determines it has immaterial copier leases, it must aggregate all its copier leases and analyze the total amount of copier leases for materiality to stakeholders .

Comments: Capital Lease vs Operating Lease

Capital leases can have an impact on companies’ financial statements, influencing interest expense, depreciation expense, assets, and liabilities. Most operating leases provide businesses with an opportunity to rent equipment that may prove too costly for an outright purchase. These leases generally cover any repairs and maintenance needs, which can be beneficial for items with extensive upkeep requirements or that may endure heavy use throughout the contract.

Fitch Assigns Stanford 2023A Rev Bonds at ‘AA’; CP at ‘F1+’; Affirms … – Fitch Ratings

Fitch Assigns Stanford 2023A Rev Bonds at ‘AA’; CP at ‘F1+’; Affirms ….

Posted: Mon, 21 Aug 2023 15:46:00 GMT [source]

The offsetting entry recorded is the capital lease liability account, which we’ll set equal to the ROU asset, i.e. link to the $372k from the prior step. Conceptually, a capital lease can be thought of as ownership of a rented asset, while an operating lease is like renting any type of asset in the normal course. A lease is defined as a contractual agreement in which one party allows another party to use an asset for a specific period of time in exchange for defined periodic payments.

How Does the Equipment Leasing Process Work?

He buys and leases a variety of equipment he uses to build residential housing. Today, he is looking at a new Bobcat he will use to help grade land and carry around lumber. An easy way to remember the difference is that a capital lease is like ownership, the item you lease is an asset, and the lease is a liability. No asset or liability is involved, just a monthly expense for the lease payments.

- The principal payment is the difference between the actual lease payment and the interest expense.

- With a capital lease, you are essentially paying the cost of the car or equipment over the term of the lease.

- One consideration, however, is that the materiality threshold for leases under ASC 842 must be applied to whole asset groups, not individual leases.

- On the other side, the loan amount, which is the net present value of all future payments, is included under liabilities.

Lease payments create the same kind of obligation that interest payments on debt create, and have to be viewed in a similar light. If a firm is allowed to lease a significant portion of its assets and keep it off its financial statements, a perusal of the statements will give a very misleading view of the company’s financial strength. Consequently, accounting rules have been devised to force firms to reveal the extent of their lease obligations on their books. For accounting purposes, operating leases aren’t shown on the business balance sheet, but the lease payments are included on the business profit and loss statement. For accounting purposes, a capital lease (sometimes called a “finance lease”) is reflected on the company’s balance sheet as an asset, with a value determined by the regulations for setting a cost basis for the asset. Leasing vehicles and equipment for business use is a common alternative to buying.

Leasing has become a popular option for businesses to acquire assets without the full upfront cost, providing flexibility and financial advantages. The Financial Accounting Standards Board changed the lease accounting game forever when they declared the ASC 842 new lease accounting standard. With a capital lease, you are essentially paying the cost of the car or equipment over the term of the lease. Each year, the sum of the lease Interest expense and the lease payment must equal the annual lease expense, which we confirm at the bottom of our model. This expense represents the lease cost and may differ slightly from the cash payment made each period. It’s important to determine your organization’s internal policy for each threshold of the classification criteria, document it, and follow it consistently.

Capital lease vs. Operating lease

You will need to estimate the value of the operating lease, and compute the present value of capital lease payments at the time of the conversion. You may also need to buy insurance to guarantee that the asset will have a specified value at a future date. Simply put, what this means is that operating lease payments are eligible for a tax deduction (because they’re considered operating expenses), while capital lease payments are not (because they’re considered debt). This type of off-balance-sheet financing allowed companies to reduce a lot of the impact operating leases had on the balance sheet, and could make the company appear, in some cases, to be more financially healthy than they really were. Users and reviewers of financial statements weren’t able to glean the insights they needed from the statements to provide a full picture of the company’s risks and liabilities. Under the previous standard, ASC 840, there used to be a substantial difference between operating leases and capital leases when it came to accounting for one or the other.

Aircraft Leasing Global Market Report 2023 – Yahoo Finance

Aircraft Leasing Global Market Report 2023.

Posted: Wed, 02 Aug 2023 07:00:00 GMT [source]

The notable difference between a capital lease and an operating lease is that for an operating lease, the asset must be returned to the owner at the end of the lease term. The principal payment is the difference between the actual lease payment and the interest expense. The year’s closing balance is calculated as lease liability + interest – lease payment. Depending on your equipment requirements, your business may choose either an operating or a capital lease — or maybe even a combination, depending on the types of assets you need. For an example of how operating lease accounting is performed in accordance with the new standard, check out this article by the CPA Journal.

Let’s start with some basic definitions and then jump into the nitty gritty, answering questions like “what qualifies as a finance lease? Capital leases are used for long-term leases and for items that don’t become technologically obsolete, such as buildings and many kinds of machinery. If you are leasing a piece of machinery that you intend to use for a long time, you probably have a capital lease.

Contact Team Financial Group to Learn About Your Equipment Financing Options

Operating leases keep businesses from having to record the assets on the balance sheet. Therefore, this is a finance/capital lease because at least one of the finance lease criteria is met during the lease, and the risks/rewards of the asset have been fully transferred. In a lease, the lessor will transfer all rights to the lessee for a specific Capital Lease vs Operating Lease period of time, creating a moral hazard issue. Because the lessee who controls the asset is not the owner of the asset, the lessee may not exercise the same amount of care as if it were his/her own asset. This separation between the asset’s ownership (lessor) and control of the asset (lessee) is referred to as the agency cost of leasing.

Under U.S. GAAP accounting rules, a capital lease is an agreement where the lessee possesses certain ownership characteristics, resulting in its financial statements treating the fixed asset (PP&E) as if the lessee was the actual owner. Both finance and operating leases represent cash payments made for the use of an asset. However, because of the distinction between the two types of leases, it is worth mentioning the differences in the mechanics of the accounting for each.

Finance Leases

In our experience, most companies choose to keep the thresholds of 75% and 90% from ASC 840 for continuity purposes, as deviating from these standard amounts will cause additional work and documentation to substantiate. If a lease does not meet any of the five criteria, it is an operating lease. A finance lease designation implies that the lessee has purchased the underlying asset, even though this may not actually be the case. The choice between these two leases depends on various factors, such as the business’s financial goals, long-term plans, and the nature of the asset. Instead of assuming ownership, the lessee is typically presented with multiple options as the lease term concludes. Access financial statement examples for before and after the new lease standard.

For tax purposes, operating lease payments are similar to interest payments on debt; these payments are considered operating expenses on the business tax form for the year. Historically, the payments you make towards the lease are accounted for as operating expenses and recorded on the income statement rather than the balance sheet, making operating leases a type of off-balance-sheet financing. When assessing lease payments under ASC 842, unlike ASC 840, if a portion of property taxes or insurance is considered a lease payment, then it should also be included for the purposes of the classification test. For most situations, if the present value of the lease payments to be made over the lease term exceeds 90% of the fair value of the asset, then the lease is considered a finance lease. As a result, operating leases did not impact a company’s debt-to-equity ratio because no liabilities were included on the balance sheet along with the lease. This ability to leave a lease off of a balance sheet could make a company appear as though they were a better investment and had stronger financials than if the lease was classified as a finance lease.

- In other words, if there is transfer of ownership, then the lease will be qualified as a capital lease and treated as such for accounting purposes.

- Accounting for operating leases is much easier since there are no assets or liabilities to book.

- These new presentation requirements provide better representation of lessees’ obligations to investors, creditors, and other financial statement users.

- This step-by-step guide covers the basics of lease accounting according to IFRS and US GAAP.

Note that the financial statements on the left side are statements before any adjustment is done. The financial statements on the right side are the financial statements after the operating lease capitalization adjustments are done. Before concluding and deciding the type of lease, one must gain proper knowledge of the accounting and tax treatment done. Based on the company’s needs and the present tax scenario, decide on one or even a combination of both types of a lease for different company assets. Some leased corporate assets have an expected lifespan that stretches over several decades, while other items may only be used for a few years before becoming obsolete. The IRS has designated rules and regulations to determine the approximate useful life of an item, which can be used when creating leasing terms.

As stated above, finance and capital leases are nearly the same in everything but name. Leases are classified as ‘finance’ when they have characteristics that make them similar to a purchase of the underlying asset. Finance leases then have imputed interest and are amortized over the life of the lease. For example, a capital lease does involve the transfer of ownership rights to the lessee, and the lease is considered more of a loan, or debt financing. Unlike an operating lease, only the interest payments are expensed on the income statement.

Operating Leases

The current and accumulated expenses for the lease are amortized, with part of the cost written off as an expense for the term of the lease. Make sure you include all the details of a capital lease to demonstrate the legitimacy of the lease. The conversion process is called “capitalizing” the lease, by turning the cost of the operating lease into a capital asset. It’s possible to convert an operating lease to a capital lease, but it’s complicated.

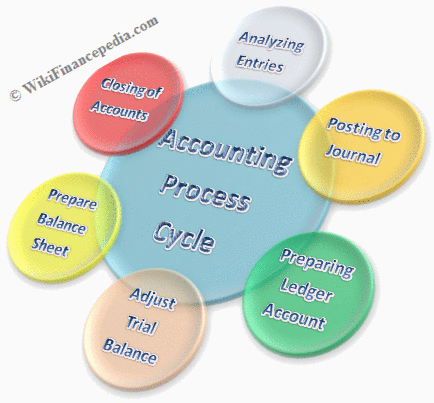

Both of them focus on different accounting methods for leases, but there are differences about them between both their function and process. Operating and capital leases are two types of treatments of equipment leases. The type of lease not only determines how the lease is is booked, it also determines the tax benefits a company will derive from the lease. While the company has some control over how a lease is classified, the greater emphasis is on the Federal Accounting Standards Advisory Board (FASAB) accounting regulations. Before discussing the tax benefits of a lease, you should understand the differences between the two types.