Since we have used the straight-line amortization method, the accounting entry will be the same every year. The Journal Entries to record the transactions will be recorded as below. Suppose ABC company issues a bond at a par value of $ 100,000 and customer deposit definition a coupon rate of 5% with 5 years maturity. When bonds are issued at par, the coupon rate offered on the bond and the market interest rate will be the same. One of the main disadvantages of issuing bonds is that it can increase a company’s debt.

- This method is permitted under US GAAP if the

results produced by its use would not be materially different than

if the effective-interest method were used. - However, interest expense of only $2,000 is actually recognized in the entry below.

- If the bonds were to be paid off today, the

full $104,460 would have to be paid back. - This is called the straight-line method of amortization of bond premium.

(Figure)Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018, and received $540,000. (Figure)Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $540,000. When a company issues bonds, it incurs a long-term liability on which periodic interest payments must be made, usually twice a year. If interest dates fall on other than balance sheet dates, the company must accrue interest in the proper periods. The following examples illustrate the accounting for bonds issued at face value on an interest date and issued at face value between interest dates. The accounting treatment for the issuance of bonds depends on whether the bonds are issued at par, a discount, or a premium.

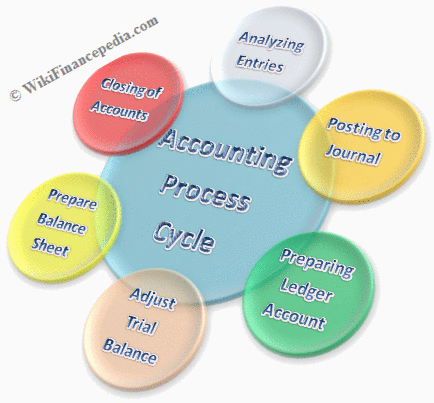

Accounting for Bonds

The subsequent accounting process is not affected except that the increases and decreases are reversed from the examples shown here for a discount. As a serial bond, Smith is required to pay $250,000 to reduce the face value each year. In addition, the unpaid face value for Year One is $1 million so the 5 percent stated rate necessitates a $50,000 year-end interest payment. Following the first principal payment, the remaining face value is only $750,000 throughout the second year. Thus, the interest payment at the end of that period falls to $37,500 ($750,000 × 5 percent). Based on the contract, the cash flows required by this bond are as follows.

Over the past year, she earned a return of $50,000 on her million-dollar portfolio of stocks and bonds. Because her tax rate is 20%, she paid $10,000 to the government.e) Your father tells you that when he was your age, he worked for only $4 an hour. The journal entry is debiting debt issue expense $ 120,000 and credit debt issuance cost $ 120,000. The journal entry is debiting debt issuance cost $ 600,000 and credit cash paid $ 600,000.

Bonds issued at Premium

Bonds are frequently issued between interest dates so an adjustment in the cash price must be made as well as in the recording of the first interest payment. As we go through the journal entries, it is important to understand that we are analyzing the accounting transactions from the perspective of the issuer of the bond. For example, on the issue date of a bond, the borrower receives cash while the lender pays cash. Bonds issued at face value between interest dates Companies do not always issue bonds on the date they start to bear interest.

Accounting for Bond Amortization

When bonds are issued and sold at discount, the interest expense will need to be calculated and recorded based on either the straight-line method or effective interest method. The amortization of an excess payment made at the time of issuance of a debt instrument is recorded in the journal as a bond premium entry. This entry represents the difference between the face value of the bond and the amount that was paid for the bond.

According to Statista the amount of mortgage debt—debt incurred to purchase homes—in the United States was $14.9 trillion on 2017. This value does not include the interest cost—the cost of borrowing—related to the debt. The first difference pertains to the method of interest amortization. Beyond FASB’s preferred method of interest amortization discussed here, there is another method, the straight-line method.

Bonds Buyback Before Maturity Example

Because interest is calculated based on the outstanding loan

balance, the amount of interest paid in the first payment is much

more than the amount of interest in the final payment. The pie

charts below show the amount of the $1,073.64 payment allocated to

interest and loan reduction for the first and final payments,

respectively, on the 30-year loan. The interest payments and the recording process will continue in this same way until all five years have passed and the face value is paid. The debtor is viewed as so financially strong that money can be obtained at a reasonable interest rate without having to add extra security agreements to the contract. Bonds payable is a form of long-term debt often issued by large corporations especially public utilities when constructing large, expensive power plants for generating electricity. Because interest is calculated based on the outstanding loan balance, the amount of interest paid in the first payment is much more than the amount of interest in the final payment.

The 8% market rate of interest equates to a semiannual rate of 4%, the 6% market rate scenario equates to a 3% semiannual rate, and the 10% rate is 5% per semiannual period. When performing these calculations, the rate is adjusted for

more frequent interest payments. If the company had issued 5% bonds

that paid interest semiannually, interest payments would be made

twice a year, but each interest payment would only be half an

annual interest payment.

Minimum wage is the lowest amount that can be paid to an employee for performing a job and paying below this amount is illegal. The quantity of labor supplied will be below the quantity of labor demanded. 2The interest recognized in the final year has been adjusted by $3 to compensate for the rounding of several computations so that the liability balance drops to exactly zero after four years. Study the following illustration, and observe that the Premium on Bonds Payable is established at $8,530, then reduced by $853 every interest date, bringing the final balance to zero at maturity. According to Statista the

amount of mortgage debt—debt incurred to purchase homes—in the

United States was $14.9 trillion on 2017. This value does not

include the interest cost—the cost of borrowing—related to the

debt.

Assess the implications of the various stakeholders and explain what your answer will be. (Figure)If there is neither a premium nor discount present, the journal entry to record bond interest payments is _______. Because of the terms specified in the contract, interest of $50,000 will be paid at the end of Year One, $37,500 at the end of Year Two, and so on as the face value is also paid. Another way to illustrate this problem is to note that total borrowing cost is reduced by the $8,530 premium, since less is to be repaid at maturity than was borrowed up front. At the end of 5 years, the company will retire the bonds by

paying the amount owed. To record this action, the company would

debit Bonds Payable and credit Cash.

By borrowing money through the sale of bonds, businesses can raise the funds needed to finance important projects without having to increase taxes. As a result, issuing bonds can be a very effective way to raise money without putting undue strain on taxes. By the end of third years, the discounted bonds payable balance will be zero, and bonds carry value will be $ 100,000. If a corporation that is planning to issue a bond dated January 1, 2022 delays issuing the bond until February 1, the corporation will not have interest expense during January. Assuming the corporation has an accounting year that ends on December 31, it will have eleven months of interest expense during the year 2022.

The company will then make periodic interest payments on the bonds until they reach maturity and the principal amount is repaid in full. When the company issue bonds to the market, it records only the net amount of $ 9.4 million ($ 10 million – $ 0.6 million). The amount company received at the beginning of the year is only $ 9.4 million ($ 10 million – $ 0.6 million). The negative balance of $ 500,000 represents the annual interest paid to investors.

The borrower will pay back the principal to whoever holds the contract on maturity date. Let’s illustrate this scenario with a corporation preparing to issue a 9% $100,000 bond dated January 1, 2022. The bond will mature in 5 years and requires interest payments on June 30 and December 31 of each year until December 31, 2026. The bond is issued on February 1 at its par value plus accrued interest. After the payment is recorded, the carrying value of the bonds payable on the balance sheet increases to $9,408 because the discount has decreased to $592 ($623–$31).

Comentários